In today's shifting market landscape, building a resilient portfolio is paramount. Modern portfolio management plans emphasize diversification, asset allocation, and risk management to navigate market volatility. A well-structured portfolio should incorporate a array of assets across different markets, providing security against unforeseen circumstances.

- Analyze your risk threshold.

- Allocate your investments across securities.

- Frequently inspect your portfolio performance and make changes as needed.

By implementing these recommendations, you can nurture a more resilient portfolio that is better positioned to weather market corrections.

Sustainable Investing: Aligning Portfolios with Environmental, Social, and Governance Goals

In today's dynamic global landscape, investors are increasingly seeking to align their portfolios with values that extend beyond monetary returns. Sustainable investing, also known as socially responsible investing, is a rapidly growing movement that seeks to apply environmental, social, and governance (ESG) factors into investment decisions.

By favoring companies with strong ESG credentials, investors can impact positive change in the world while also seeking to generate sustainable returns. This approach recognizes that companies play a crucial role in addressing global challenges such as climate change, social inequality, and integrity issues.

Sustainable investing offers a range of plans to meet investor objectives, from actively preferring companies with exemplary ESG practices to bypassing companies involved in harmful activities. A well-diversified portfolio that incorporates ESG factors can help mitigate risks and augment overall portfolio resilience.

- Some investors choose to prioritize on specific ESG themes, such as renewable energy or sustainable agriculture.

- Others may prefer a more broad-based approach that considers the full spectrum of ESG factors.

- Regardless of their tactic, investors who embrace sustainable investing are committed to creating a more just and sustainable future.

Navigating Market Volatility: Effective Portfolio Diversification Techniques

Market volatility can be a daunting prospect for investors. vary market conditions often lead to uncertainty and risk. However, savvy investors understand the importance of applying effective portfolio diversification techniques to minimize potential losses and enhance long-term returns.

Diversification involves allocating investments across a spectrum of asset classes, sectors, and geographic regions. By forming a well-diversified portfolio, investors can smooth the impact of negative market swings on their overall returns.

A popular approach to diversification is the typical 60/40 portfolio, which comprises 60% in stocks and 40% in bonds. However, there are diverse other diversification strategies that investors can explore.

Numerous popular portfolio diversification techniques include:

- Asset Allocation: This involves allocating investments among different asset classes, such as stocks, bonds, real estate, and commodities.

- Sector Diversification: Investing in companies from multiple sectors of the economy can minimize risk by compensating the performance of any sole sector.

- Geographic Diversification: Expanding investments across different countries and regions can support in managing risk associated with cultural factors in a definite country or region.

Maximizing Investment Returns

Achieving financial check here success requires a well-structured asset allocation strategy. Effective portfolio enhancement involves strategically allocating assets across different asset classes to maximize returns while simultaneously controlling risk. A diversified portfolio structure helps spread susceptibility and potentially smooths market volatility. Financial advisors should regularly review their portfolios to ensure they align with their investment targets. By employing a disciplined approach, investors can boost the probability of achieving their long-term financial ambitions.

Crafting Optimal Investment Portfolios

A well-crafted investment portfolio is like a finely tuned machine, designed to deliver consistent returns while mitigating risk. At the heart of this process lies asset allocation, the strategic distribution of investments across various asset classes such as securities, debt securities, and land. By carefully apportioning these assets, investors can tailor their portfolios to be in harmony with their individual risk tolerance, investment horizon, and financial goals.

Diversification is a key principle guiding asset allocation. By spreading investments across different asset classes, investors can reduce the overall volatility of their portfolio and augment its resilience to market fluctuations. Moreover, each asset class tends to perform differently under various economic conditions, providing a buffer against potential losses in any one sector.

- Review your risk tolerance: Are you comfortable with high market volatility or do you prefer a more cautious approach?

- Identify your investment horizon: How long do you plan to invest your money? Longer time horizons allow for increased risk-taking.

- Clarify your financial goals: Are you saving for retirement, a down payment on a house, or something else? Your goals will influence the appropriate asset allocation strategy.

Regularly rebalancing your portfolio is crucial to maintain its alignment with your investment objectives. Market conditions can change over time, impacting the performance of different asset classes. By periodically rebalancing, investors can ensure that their portfolios remain diversified and continue to meet their goals.

Long-Term Growth Through Performance Analysis and Rebalancing

Regularly analyzing your portfolio's performance is crucial for reaching long-term investment goals. Through a comprehensive review, you can recognize areas requiring may require adjustment and enhance your portfolio's framework with your economic objectives. Rebalancing your portfolio involves conducting strategic changes to asset allocations, bringing it back into equilibrium with your initial plan.

- Key benefits of regular portfolio performance analysis and rebalancing include:

- Risk reduction

- Boosted returns

- Greater investment variety

A well-defined rebalancing routine can help you stay on track and control the impact of market volatility. Remember that portfolio management is an ongoing process where requires continuous evaluation.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Keshia Knight Pulliam Then & Now!

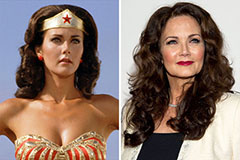

Keshia Knight Pulliam Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now!